The geography of foreclosures, home values continues to expose sprawl

Posted October 28, 2008 at 1:31PM

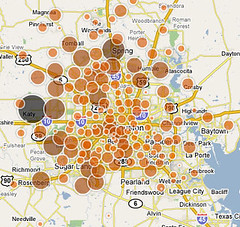

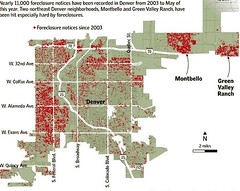

Take a look at these foreclosure maps of metro Houston and Denver, respectively. In Houston, the larger and darker dots indicate locations with more foreclosures; in Denver, the red areas have the most foreclosures:

(There is an interactive version of the one of Houston on the Houston Chronicle website.)

Once again, the most foreclosures are in the outlying areas. Confirming the graphic evidence, my sister-in-law, who lives in a sprawling subdivision built about 10 years ago 25 miles or so from downtown Washington, reports that there are two foreclosure signs within a few doors of her house. There are none in my city neighborhood, where the houses are of roughly comparable value.

There's something profoundly sad about this. I really hope that part of the nation's economic recovery will include some refinancing relief for people who got caught in a bind.

There's further evidence in a recent Washington Post article written by Peter Whoriskey and Zachary Goldfare, which notes the top five metro areas for  foreclosures in the third quarter of this year:

foreclosures in the third quarter of this year:

- Stockton, CA

- Las Vegas

- Riverside, CA

- Bakersfield, CA

- Fort Lauderdale

Wow. Sprawling, Sun Belt areas, every one.

The Post had another feature in its Real Estate section on Saturday, comparing home value trends in eight DC-area neighborhoods. Here are the results:

- Only one, a city neighborhood with a Metro rail transit station, showed an upward trend over the last year.

- Four neighborhoods were considered "stable," although all showed slightly downward trends. Three of them were either in the city or in older suburbs.

- The other three all showed sharp downward trends, and all three were in outlying areas.

An accompanying story by Dina ElBoghdady quotes Dan Fulton of Fulton Research, which performed some of the analysis reported in the Post, as saying that "the more established areas near major job centers came out ahead of the outlying suburbs that were overbuilt during the housing boom."

Although I like it that all this confirms that the future is with relatively centrally located, transit-accessible neighborhoods, it is hard to take much pleasure in being right on this one.