Long Island municipality fights back to save energy retrofits

Posted August 10, 2010 at 1:35PM

Babylon, New York, a city of a little over 200,000 people on Long Island, is fighting to save its recently adopted energy retrofit program from being killed by an independent federal agency at odds with the Obama administration’s Energy Department. Now why are you scratching your head trying to grasp that? I don’t blame you, to be honest. I’m still trying to sort it out.

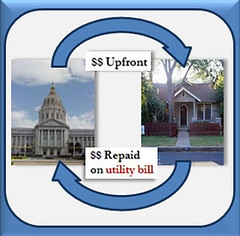

An innovative concept recently adopted in many places across the country called PACE (for Property Assessed Clean Energy) applies proceeds from the sale of bonds to loans that help commercial and residential property owners finance energy retrofits (efficiency measures and small renewable energy systems). The borrowers then repay the financing over 20 years via an annual assessment on their property tax bill.

An innovative concept recently adopted in many places across the country called PACE (for Property Assessed Clean Energy) applies proceeds from the sale of bonds to loans that help commercial and residential property owners finance energy retrofits (efficiency measures and small renewable energy systems). The borrowers then repay the financing over 20 years via an annual assessment on their property tax bill.

PACE bonds can be issued by municipal financing districts or finance companies and the proceeds can be typically used to retrofit both commercial and residential properties. The concept emerged with the passage of enabling legislation in California in 2008, and many other states have since followed suit. And so has the federal government. Mostly.

According to a story written in the New York Times by Todd Woody, the federal Department of Energy had signaled its intention to promote the programs, and the green jobs they foster, through $150 million in stimulus funds that would be used to help communities defray program administrative costs. But there has been a serious setback:

“Fannie Mae and Freddie Mac, the government entities that guarantee more than half of the residential mortgages in the United States, have different priorities. They are worried that taxpayers will end up as losers if a homeowner defaults on a mortgage on a home that uses such creative financing. Typically, property taxes must be paid first from any proceeds on a foreclosed home.”

Fannie and Freddie are apparently responding to their own regulator, the Federal Housing Finance Agency, which has told the two mortgage giants to “steer clear of the program,” according to a news story on NPR’s Morning Edition. (FHFA is an independent agency not subject to direct executive control.) As a result, Fannie and Freddie sent letters to mortgage lenders in May stating their position that government-supported PACE liens cannot take precedence over basic mortgage repayment, and the two have refused to approve loans on properties with outstanding PACE assessments.

Fannie and Freddie are apparently responding to their own regulator, the Federal Housing Finance Agency, which has told the two mortgage giants to “steer clear of the program,” according to a news story on NPR’s Morning Edition. (FHFA is an independent agency not subject to direct executive control.) As a result, Fannie and Freddie sent letters to mortgage lenders in May stating their position that government-supported PACE liens cannot take precedence over basic mortgage repayment, and the two have refused to approve loans on properties with outstanding PACE assessments.

The effect has been to pit the Obama administration against the FHFA and the two quasi-independent mortgage insurers and put a major chill on state and local programs. PACE supporters are now turning to Congress for relief so that the loans for energy retrofits can resume without interference from the two mortgage entities.

Meanwhile, California attorney general Jerry Brown has sued FHFA over the issue, and so has Babylon. The acting director of FHFA has issued a terse statement indicating that it will “defend vigorously” its position. To see how the program has been working on the ground, and why Babylon believes it is worth fighting for, see this video produced by NRDC’s OnEarth magazine:

Move your cursor over the images for credit information.