How the evolving housing market will help sustainable communities

Posted April 4, 2012 at 2:38PM

I was privileged to be invited to participate along with some very smart urban thinkers in a recent program on the resilience of cities. The program was sponsored by the New America Foundation, and I was on the first panel.

The subject of the Great Recession came up, and I volunteered that I thought the persistent economic slump had hurt both good and bad development. But I offered that it had hurt bad development (e.g., land-consuming, totally automobile-dependent subdivisions on the suburban edge) more than good, given that new, speculative development in sprawling outer locations had virtually ground to a halt. (What you see on the ground now that looks new was actually invested and entitled a decade or more ago.) Many city infill and redevelopment projects, by contrast, are going forward and even commanding market premiums for their urban locations. Housing values have declined much more, on a percentage basis, in sprawling subdivisions as compared to walkable, centrally located neighborhoods, many of which have even held steady or increased in value.

I’ve written several times about the various indicators that suggest this is so, and about some of the reasons why. What I haven’t done recently, though, is update those data. Fortunately, my friend Ben Brown of the planning and development advisory firm PlaceMakers has recently looked at the latest information and brought us all up to speed.

Baby Boomers and Millennials, shaping a community near you

Number one among reasons why this trend toward more city living and walkable suburban living is the “great convergence,” as Laurie Volk calls it, of the two largest generations in American history. Together the Baby Boomers (born 1946-1964) and Millennials (born 1981-2000), account for more than 150 million Americans. Ben points out that a number that size is sufficiently large that even small portions within it can “have multiplier effects on housing supply and demand.”

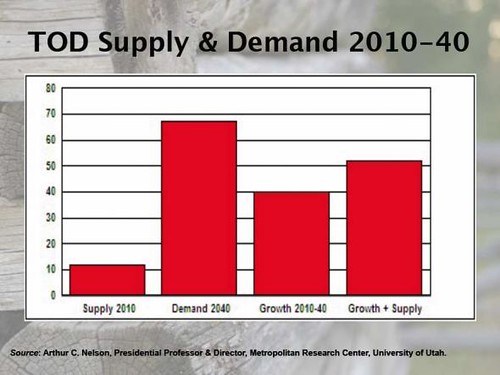

The effect is being felt, because together the two super-generations are reducing the share of total households with children, traditionally the portion of the market most interested in suburban homes with sizeable lots for kids to play in and grownups to maintain. Neither the Millennials with their preference for urban lifestyles nor the empty-nesting Boomers fit that market to nearly the same degree as, say, their parents did. Consider, for example, this graphical representation of demand for transit-oriented development:

Ben also points out that the changing market is borne out in newer consumer preference surveys, citing The National Association of Realtors’ 2011 Community Preference Survey. In the NAR data, 58 percent of respondents indicated a preference for “a neighborhood with a mix of houses and stores and other businesses within an easy walk.”

As we all know, the current mixture of housing on the ground – especially that built within the pre-recession time frame of from 1975 to 2005 or so – doesn’t come anywhere close to matching the stated preference for walkable, mixed-use neighborhoods. Wonder no more why city living is becoming more expensive.

Overbuilt and underbuilt markets

On the other side of the supply equations, real estate analyst extraordinaire Arthur C. (Chris) Nelson was telling us as long ago as 2006 that, because of changing demographics and consumer preferences, the supply of large-lot suburban housing was already overbuilt in comparison to future demand. As a result, Nelson predicted that the value of large-lot properties was going to decline to less than their amount of mortgage debt, meaning that owners would owe more than their houses were worth. We now know how that turned out.

Indeed, we now have examples where farmland that was sold for real estate speculation is now being sold again, back to farming investors who seek to return the land to crop production. If that doesn’t tell us enough about the shifts in the market for exurban housing, than consider the relative demise of the McMansion era of neo-trophy houses, their popularity now only a small fraction of what it once was.

To correct the imbalance between supply and demand in the marketplace, we need more walkable neighborhoods. Ben quotes Chris Leinberger and Patrick Doherty on the subject, in an article from a little over a year ago:

“Both of these huge demographic groups want something that the U.S. housing market is not currently providing: small, one-to-three-bedroom homes in walkable, transit-oriented, economically dynamic, and job-rich neighborhoods.”

Is rental property the next wave?

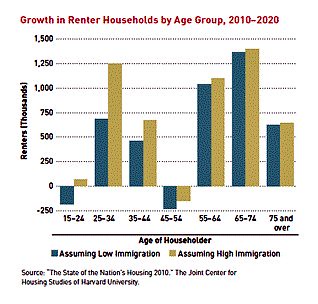

There may be another market shift afoot, too: from a housing market dominated by owner-occupied properties to one with a higher share of rentals. Ben quotes Doug Bibby, president of the National Multi-Housing Council:

“The country is on the cusp of fundamental changes in our housing dynamics. Preferences are driving more people away from the typical suburban house and toward the type of lifestyle that rental housing offers.”

Both The New York Times and Birmingham News have reported stories this year to the effect that the demand for rental housing is outstripping supply, driving up the price of rent. Rentals went up in downtown Birmingham by 18 percent over the last decade.

I’ll confess to a bit of ambivalence over that news. Some people in the field whom I like and respect a great deal, such as Richard Florida, argue that more renters are better for cities. But I still recall when, in my late 30s, I was finally able to afford a condo, and the near-immediate greater sense of responsibility I felt in wanting to care for the property I now owned. In my current neighborhood of near-identical homes built some 80 years ago, the rental properties are nearly always less well kept than their owner-occupied neighbors. I wonder how that is good, exactly, for the neighborhood.

That said, I suppose increasing transience is here to stay and, along with it, folks who are reluctant to put down economic roots in a neighborhood. With housing prices much less stable than they were even a decade ago, more people are going to seek less risky places to put long-term capital. In Ben’s article, he cites Lesley Deutch of John Burns Real Estate Consulting as forecasting a 9.1 million increase in renter households over the next five years, more than double the rate of the last five years.

But Ben, whose article is pro-rental in general, acknowledges that the prospect of more renter households does bring some worry among potential neighbors:

“The problem is, outside of big city downtowns, where demand for rentals has always been high, the design and construction of apartments, town houses and other rental models hasn’t consistently measured up to the range and standards of single-family, for sale residences. In too many places, ‘for rent’ and ‘affordable’ have become code words for subsidized government housing or cheaply built complexes likely to be opposed by neighbors worried about their property values or the increased traffic congestion. There’s a stigma to overcome.

“The sure way to aggravate in-town neighborhood fears is to import suburban multifamily designs that assume no one can live without a parking space outside their door. Or relate to human beings who are not fellow occupants of their rented space. The ideal approach would be to produce neighborhood-appropriate rental choices that are impossible to tell from for-sale dwellings.

“Historic in-town neighborhoods provide the best models. True townhouses. Appropriately scaled stacked flats. And, of course, single-family detached homes that toggle between owner-occupied and rented depending upon market conditions and owner preferences.”

His last paragraphs pretty much describe my own current neighborhood. And, while my description of better upkeep in (and perhaps less noise from) the owner-occupied houses is accurate, it’s still a great neighborhood to live in. The ideal in my neighborhood, actually, may be the basement apartments in otherwise owner-occupied houses or occasional boarders who live with families in owner-occupied homes. In those cases, we have both renters of affordable properties and on-premises owners who make sure their homes are cared for and their tenants respect their neighbors.

Is small the new large?

It is worth noting that Ben’s observations are wholly consistent with those of a major Urban Land Institute report for real estate investors that came out at the end of last year:

“The influx of Generation Y, now in their teens through early thirties, will change housing demand. They are comfortable with smaller homes and will happily trade living space for an easier commute and better lifestyle. They will drive up the number of single households and prompt a surge in demand for rentals, causing rents to escalate.”

That highly detailed report went on to discuss trends in commercial development, senior housing, and the effects of technology and energy (all quickly summarized here).

Beyond rentals, the clear changes in the residential marketplace also bode well for innovative approaches to smaller-footprint but nonetheless high-quality types of housing, such as “pocket neighborhoods” of cottages and slightly larger homes arranged around a common green, as championed by Ross Chapin. Downsizing trends may provide opportunities as well for more applications of the “Katrina Cottages” designed for quick rebuilding along the Gulf of Mexico coast following the loss of homes to Hurricane Katrina. A LEED-Platinum version of the latter was just celebrated in a cluster of 29 of the homes on two acres in Ocean Springs, Mississippi.

(Marketing tip: it may be time to lose the “Katrina” part of the trademark for these cottages – whose concept I love – since the potential market might increase without the association with temporary housing in the context of a national tragedy. Just saying.)

Many thanks to Ben for his latest writing on these subjects. Check out the rest of his firm’s thoughtful blog, here.

And you can watch an archived video of my panel from two weeks ago on city resilience, here.

Related posts:

- What's going on with new home sizes - is the madness finally over? (February 9, 2012)

- The new economy: work closer, live smaller, connect better (December 30, 2011)

- Geography of housing recovery favors cities and walkable neighborhoods (October 26, 2011)

- The collapse of the "key assumptions" of sprawl (April 25, 2011)

Please also visit NRDC’s Sustainable Communities Video Channel.