How Baltimore helps convert vacant properties into rehabbed homes

Posted May 31, 2013 at 1:45PM

This will eventually be an article about Baltimore’s terrific Vacants to Values program, which is targeting abandoned housing for reinvestment and succeeding. But, first, some background:

One of the nation’s great tragedies of the latter half of the 20th century was the severe disinvestment of our inner cities as (mostly white, middle class) people fled to the suburbs. With no controls whatever on suburban sprawl, our metro regions hollowed out their cores, leaving behind blight, a severely diminished tax base, and a host of social problems. While I have problems with the phrase “shrinking cities” applied to areas where the suburbs have flourished, there’s no question that the hardships faced by core cities that lost population – even now-booming Washington, DC lost 30 percent of its population between 1953 and 1998 – were, and still are, very, very real.

This was just as devastating for the economy and the environment as it was for our social fabric. One could write a book about that (and, in fact, at NRDC we did). Some of my favorite recovering city districts such as Old North in St. Louis, Over-the-Rhine in Cincinnati, and the South Bronx in New York, lost overwhelming portions of their populations. The good news is that each of those three are now coming back in great form (Old North; Over-the-Rhine; South Bronx).

Baltimore’s significantly abandoned districts have been slow to rebound, however. The city estimates that it has about 16,000 vacant buildings, 75 percent of them privately owned. About 10,000 of them are in areas where there still is no development demand.

Baltimore’s significantly abandoned districts have been slow to rebound, however. The city estimates that it has about 16,000 vacant buildings, 75 percent of them privately owned. About 10,000 of them are in areas where there still is no development demand.

More encouraging, perhaps, are the 6,000 in neighborhoods where there is some development interest, such as in the area near Johns Hopkins hospital, but not quite enough for the private market to respond without a boost. This is where the city comes in.

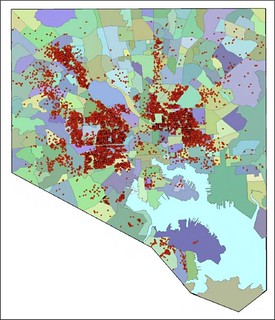

In late 2010, Mayor Stephanie Rawlings-Blake initiated the Vacants to Value program. In particular, the city undertakes careful market analysis of Baltimore neighborhoods to determine their potential for development. It then compares the geography of the market findings with the geography of vacant properties to identify areas for different types of stabilization, rehabilitation, and development incentives and support. It’s a six-part program intended to strengthen the market in areas of potential:

- Streamline the disposition process for city-owned properties. This allowed the city to sell five times as many vacants in 2012 as in 2010.

- Intensify and streamline code enforcement. In 85 designated neighborhoods with market potential, the city has issued 700 citations for building code violations (each carrying a $900 penalty) and filed 300 receivership cases to force abandoned properties to auction. Before the program began, these cases had to be litigated one at a time.

- Designate and facilitate investment in “community development clusters” in “emerging markets” near areas of strength. The city has sold 90 percent of its own properties to private developers in these areas and catalyzed $21.4 million of private investment. Residential building permits rose 13 percent in these clusters, compared to 4 percent for the city as a whole, since the program has been in effect.

- Provide homebuyer incentives. In one program, for example, the city has provided $10,000 “booster” payments to 117 households.

- Support large-scale redevelopment (including multifamily housing) in distressed areas by clearing areas to become development-ready.

- Where necessary, undertake demolition of blighted properties in areas of no market interest to “maintain, clear, hold and identify non-housing uses” such as green lots and community gardens. This last element is essentially a land-banking program.

As noted by my friend (and GWU faculty colleague) Joe Schilling in an interview with NPR, the program is innovative in at least two ways. From the interview summary:

“There are two pieces of Baltimore’s Vacants to Value program that stand out, first its targeted and strategic approach, and second its on-going public information workshops. On the front-end, the City analyzes the market demand for housing block by block and overlays this information with their vacant property inventory. From this analysis, the City is able to identify emerging markets and better target their resources.

“In addition to this strategic focus, the City also hosts bi-weekly workshops to teach the public how to buy vacants. The focus of the workshops rotates, instructing the public on: how to buy city-owned properties, how to rehab properties, how to market rehabbed properties, as well as how to take advantage of home-buyer incentives.”

A market-based approach is key to the city’s efforts. An excellent analysis of the program by the Federal Reserve Bank of Richmond explains:

“[Vacants to Value] presents a blueprint for redeveloping the many thousands of vacant properties located in areas the city has determined have viable real estate markets that, with limited public activity, can attract private investment, be rehabbed, and re-occupied.

In these areas, the city expects a private property owner to be able either to sell his property unimproved or, after investing to make it habitable, be able to rent or sell it.

“V2V also emphasizes using private market forces, rather than public capital, to target approximately 700 vacant properties located in weak market areas. Investments in these areas will be on a large enough scale--encompassing at least a city block--to catalyze additional private investment. These projects will incorporate mixed-income housing development. V2V acknowledges that it cannot rid Baltimore of all its vacant houses. Instead, it targets investment to clusters of vacant property near functioning markets or seeks to leverage substantial resources that will lead to sustainable improvements.

“The idea is that by targeting a reasonable amount of investment to real estate markets that have some existing strengths, the city might be more likely to restore healthy market conditions than by following a ‘worst-first’ approach that simply allocates resources to the areas with the highest vacant property rates.”

I was given a tour of some of the community development clusters by Baltimore housing officials, and took the photographs accompanying this article. In some cases one could see side-by-side the benefits of the program in recently rehabbed properties compared to ones not yet addressed. Inside, I was impressed by the rehab standards of the properties now being put on the for-sale market by their (usually small) developers. (For a good description of one, see this article from last month in The Baltimore Sun.) I was also impressed that each of the several developers I spoke to during the tour was making use of the state’s historic property tax credit, demonstrating the value of that program as well.

Vacants to Value does have its critics. The Baltimore franchise of the ever-snarky City Paper ran a headline called “Still Pretty Vacant” over a story by Edward Ericson, Jr., claiming that the housing office was less than forthcoming in supplying data about the program and asserting that it was falling short of what Ericson said were Mayor Rawlings-Blake’s goals for it. (Ericson says the mayor promised 1500 renovated houses in the program’s first year. The existence of that “goal” is disputed by city officials.) A story from WBAL-TV reports that 450 properties had been rehabbed in the first two years of the program, and that the mayor hopes for 3000 more over the next three years.

At best, though, the program is a little over two years old, having started from scratch. Some of the data show marked improvement on important steps on the road to recovery (for example, the disposition of city-owned properties; the citations for code violations). The renovated properties I saw looked fantastic, especially in comparison to their not-yet-rehabbed neighbors, and even the critical stories contain positive anecdotes. There is progress afoot: let’s applaud the program so far and give it more time to accumulate more success.

(I do find the existence of 10,000 remaining properties that the program can only demolish a bit depressing. That part is not the program’s fault, though; the problem is that the Baltimore economy is not strong enough to support more inner-city growth.)

Meanwhile, Vacants to Value is a clear step in the right direction. What I would like to see next is interest in the city’s part in making these development clusters greener. There were blocks in my tour with few street trees, broken sidewalks, and too-wide roadways, all of which could be fixed. Bringing in some strategic vegetation would not just beautify the neighborhoods but also begin to address what I suspect are some significant stormwater runoff problems caused by all that impervious surface. In addition, I didn't see much if any transit in the clusters during the 3-4 hours I spent there.

While the city may not be able to afford a total greening of the program with appropriate infrastructure upgrades, how about a green pilot program in one of the key development areas? The work of the Talbot-Norfolk Triangle area in Boston is instructive as to the possibilities, and preference in the bidding process for purchase of properties could be given to developers who are willing to cost-share some of the implementation. I guarantee it would raise property values and tax revenues in locations where the city is willing to invest. Just an idea.

Visit the city’s Vacants to Values portal for more information about the program.

Related posts:

- The case for building on a city's historic assets (April 29, 2013)

- The essential elements of green cities (by Lee Epstein) (April 3, 2013)

- How a tough neighborhood is building a stronger future with vivid public art (November 16, 2012)

- A low-income community taps homegrown leadership for a brighter future (October 17, 2012)

- Retrofitting inner-city neighborhoods for energy efficiency (October 1, 2012)

- The right approach to green, inclusive revitalization (May 10, 2012)

- A remarkable grassroots revitalization matures and thrives in Boston (March 26, 2012)

- Is 'gentrification' always bad for revitalizing neighborhoods? (October 19, 2011)

Move your cursor over the images for credit information.

Please also visit NRDC’s sustainable communities video channels.