The new economics of place: sustainability = $$$

Posted September 5, 2008 at 6:59PM

The economics of real estate have fundamentally changed. So says Scott Polikov, writing for citiwire.net.  In a very well-written column, Polikov lays out the underpinnings of what he believes to be a new real estate paradigm:

In a very well-written column, Polikov lays out the underpinnings of what he believes to be a new real estate paradigm:

“We all knew the pattern, popularized after World War II and mostly triumphant since. A smart builder discovers and buys an inexpensive piece of cornfield or pasture. Up go single-family houses, or, more recently, many townhomes. Proximity to stores, offices, other conveniences (except perhaps schools) is irrelevant: everyone will be driving anyway. The successful sales prove it.

“No longer. Almost overnight, the ground rules for development have been eviscerated. Sure, real estate calculations of cash flow and value are still being made . . .

“But, have you recently heard of a developer securing a construction loan for virtually any kind of standard real estate residential development? His or her banker likely told them that ‘we aren’t originating construction loans at this time.’

“Why? The fundamentals of the 'bedroom community' economy have collapsed. Banks have not figured out at what point they will hit the bottom of their financing crisis. The need for radically improved, sustainability-focused strategies has never been more compelling than in this time of looming home foreclosures, $4 a gallon gas, an economy in decline, and broad agreement that the earth’s fragility is not longer just the cry of the fringe.

“The new development 'secret' is simple but critical: not just to reject our old way of building housing units any place, but to focus early and hard on creating and strengthening whole communities . . .

“Economic development worth its salt has become firmly connected to place, and to the environment. The quality of life of our neighborhoods, our cities and our regions has now become a bottom-line factor for many business decisions.”

Polikov points out that much of the “new” sustainable design is, in fact, based on time-honored principles practiced by early planning and development leaders like J.C. Nichols, who developed Kansas City’s1920s model of walkable urbanism, Country Club Plaza, still one of that city’s best neighborhoods.

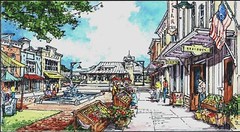

Polikov also writes about a 2000-acre transit-oriented development that his own firm, Gateway Planning Group, has planned for Leander, Texas, along a rail-oriented growth corridor north of Austin. (The images in this post are of the firm’s plans for the development.) Gateway’s economic analysts project that the award-winning development will have a built-out value of almost $2 billion, twice what would be expected of conventional suburban development on the same site. The project’s investors can expect to do very well indeed, compared to the old sprawl paradigm.

As Polikov writes, “[w]e fully expect to sustain the region’s economy, reduce its ever-expanding carbon footprint, and achieve sustainability on a site otherwise destined for classic sprawl.” I think they are on their way to help do just that. Read the full commentary here.