Strong central cities may help in weathering the recession

Posted March 30, 2009 at 1:42PM

A number of things came across my desk or computer screen in the last few days that all point to the benefits of strong central cities in dealing with the recession.

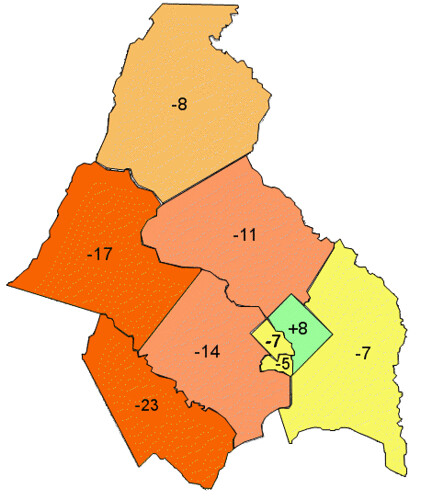

First, a story by Alejandro Lazo in Saturday's Washington Post once again demonstrated that central locations in our metro area are not suffering the same declines in housing values as outer locations. I have covered this before (see also here), but what's new is a full year's worth of data on all home sales in the area in 2008. Only one jurisdiction in the region had its median home sales price increase, compared to 2007: Washington, DC itself, with an 8 percent increase.

Region-wide, the median sales price declined 8 percent. Other than DC, only three of the region's nine major jurisdictions did better than the region as a whole, and all three are close-in suburbs: the city of Alexandria (-5 percent) and Arlington County (-7 percent) in Virginia, and Prince George's County, Maryland (-7 percent). Frederick County, Maryland's performance was identical to that of the region as a whole with a drop of 8 percent in median price. The two worst-performing jurisdictions are both on the metro fringe: Loudoun (-17 percent) and Prince William (-23 percent) Counties, both in Virginia.

There was, of course, lots of variation within the major areas and, in some cases, independent jurisdictions within the major counties whose data are not reflected in my limited map-making skills. The data also do not include condo sales at all. The Post article has all the detail. But I think the general pattern is clear.

Second, Harvard economics professor Ed Glaeser, who seems to be everywhere lately, has a blog post on the New York Times site in which he discusses why some places fare better than others in depressed economies. He examines unemployment rates, and cites the level of education in the workforce (good for employment) and the amount on manufacturing in the local economy (bad for employment) as correlating factors. No surprises there.

But then it gets interesting. Metro areas with strong centers, it turns out, have lower rates of unemployment than those without:

But then it gets interesting. Metro areas with strong centers, it turns out, have lower rates of unemployment than those without:

"A third variable that predicts the level of unemployment is the centralization of the metropolitan area. About five years ago, the U.C.L.A. economist Matthew Kahn and I wrote a couple of papers about sprawl in America's cities. One benchmark measure of decentralization that we used was the share of employment in ZIP codes that were within five miles of the metropolitan area's urban center. As the next figure [a graph accompanying Glaeser's post on the Times site] shows, January's unemployment is lowest in those areas that are most centralized.

"While it is true that skilled places are more centralized, and manufacturing cities are less so, this effect continues to be statistically significant even when I control for skills and manufacturing . . . the facts do suggest that smart people, connected by urban density, are doing a better job of dealing with adversity."

Glaeser's graph shows the lowest unemployment rates are found in locations with the highest numbers of jobs located within five miles of the regional center.

The third thing that came to mind in the last few days is the sad plight of Detroit, a severely depressed city both highly decentralized (the least centralized on Glaeser's graph) and highly dependent on manufacturing. According to the Michigan Association of Realtors, the average sales price of a Detroit home fell to $13,638 in January,  a 42 percent decline from the average home price in January 2008. By at least one report, the median sales price of a home in Detroit in December was only $7,500, and that is not a typo.

a 42 percent decline from the average home price in January 2008. By at least one report, the median sales price of a home in Detroit in December was only $7,500, and that is not a typo.

Tim Jones reports in the Chicago Tribune that "Detroit, which has lost half its population in the past 50 years, is deceptively large, covering 139 square miles. Manhattan, San Francisco and Boston could, as a group, fit inside the city's boundaries. There is no major grocery chain in the city, and only two movie theaters." The city's unemployment rate, meanwhile, is 22 percent. Man, all that's hard to read.

While the recession may do the least damage in places where centers are strong, it can be extraordinarily cruel elsewhere.